04122025 Bharath, Editorials:

Master Class on Investor Trends: 3/3

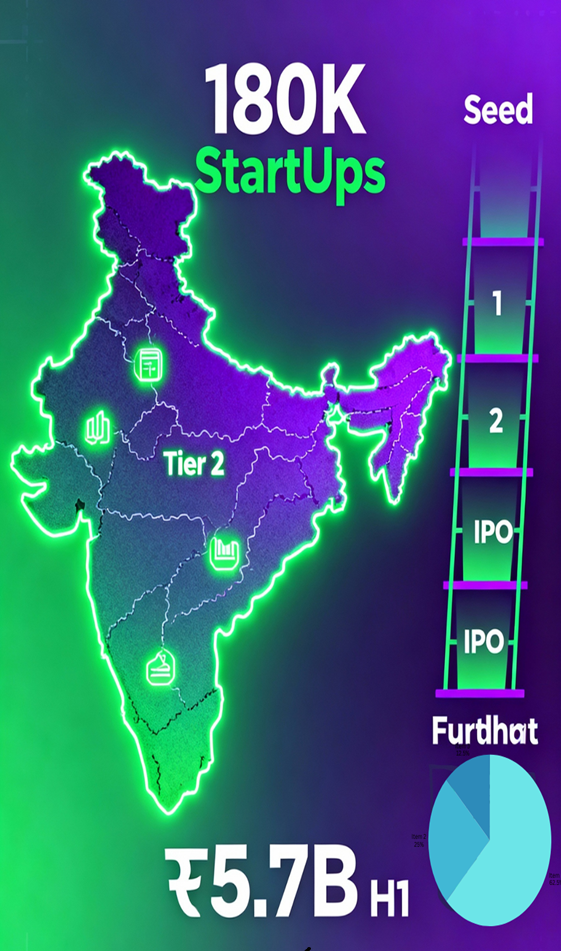

- $5.7B raised H1 2025—late-stage or seed: Where’s your sweet spot? ?

- Infrastructure woes in Tier-3: High-speed net or highway first for scale? ?

- Angel tax gone—does it unlock family offices for your pre-seed? ?

- 11,000 closures in 2025: Correction or signal to pivot harder? ?

- Global #3 ecosystem—can you compete with China’s deep-tech muscle?

Funding Types & Stages: The Indian Playbook

- Pre-seed/Bootstrapping: Friends/family (?10-50L), accelerators (Y Combinator India-style). ?

- Seed: Angels/Seed funds (?1-5Cr) for MVP validation (e.g., lesser-known EV charger Krutrim). ?

- Series A: VCs (?20-100Cr) post-PMF (Zerodha’s debt-free twist). ?

- Series B/C+: Growth capital (?100Cr-1K Cr) for scale (DeHaat’s agritech blitz). ?

- Late-stage/Pre-IPO: PE, debt (?1K Cr+); unicorns like Meesho hit $600M. India twist: Venture debt rises 3x in 2025 for cash-flow positive SaaS. ?

Types and Stages of Investments:

| Stage | Typical Investors | Example Sectors | Recent Examples |

| Bootstrapping | Founders, Friends & Family | All | Most early StartUps |

| Angel/Seed | Angels, Micro-VCs | Tech, SaaS, Healthtech | UnifyApps, FlexifyMe |

| Series A/B/C | VCs, Institutional Investors | Fintech, Deeptech, AI, Edtech | OnFinance AI, Affluense AI |

| Public/IPO | Institutional, Retail Investors | E-commerce, SaaS | Flipkart’s IPO journ |

Real Examples from the Ecosystem

- Famous: Flipkart’s $1M Series A (2009) sparked e-comm boom; Zomato bootstrapped to $13B IPO.

- Sharp caselets: Women-led Lilac Insights (HealthTech analytics, $6M seed via SISFS nudge);

- Tier-3 EV play BluSmart (?200Cr Series B, profitability pivot).

- 2025 funding updates: $169M weekly surges in ClimateTech like Varuna (water tech). ?

Trending Domains & Stage Breakdown

2025 StartUp trends favor DeepTech/AI (30% seed deals), ClimateTech/EVs (Series A scale), FinTech/HealthTech (Series B profitability), SaaS/Tier-2 agrilogistics (growth). Women entrepreneurship in India shines in edtech/impact (25% funding dip reversed via grants). Investors expect: Seed=team hustle; A=metrics; B+=path to EBITDA. Prep tip: Founders, build data rooms 90 days pre-raise. ?

Founder Prep & Investor Expectations by Stage

- Seed: Hustle MVP, 10+ pilots; VCs want founder-market fit. ?

- A: 100+ paying users, churn <5%; expect 18-month runway proof. ?

- B+:?100Cr ARR trajectory; governance audits mandatory.

- Future: By 2030, domestic LPs dominate, AI-native unicorns rule—position now. ?

A quarter-century after the first Indian StartUps hustled from cramped apartments, the funding story has come full circle, from easy money and vanity metrics to disciplined capital, real unit economics and thoughtful founder–investor partnerships.

Today’s smart money backs resilient models in DeepTech, ClimateTech, FinTech and beyond, while grants and central schemes quietly power the next wave from Bharat’s Tier-2 and Tier-3 cities. The question now isn’t whether capital is available, but whether founders are ready to play this sharper game governed, data-driven and purpose-led so their next round funds impact and profit, not just pitch-deck dreams.

Way2World invites you to follow our pages on Facebook and LinkedIn. #Way2World provides insights and news regarding #Founders, #Co-Founders, #WomenEntrepreneurs, #WomenLeaders, #Mentors, #Innovation, #Incubators, #Accelerators, and #Listing. Our #Articles, #Reviews, and #Stories explore topics related to #Funding, #IndianStartUps, their #BusinessServices, as well as the impact of #Technology. Please note that this content, including images, is generated with the assistance of AI tools and is intended solely for informational purposes regarding current trends. It is not a recommendation. We advise conducting thorough analyses tailored to your specific needs and consulting with experts in the field. Content includes contributions from the Internet – RajKishan Ganta.

DISCLAIMER: The information presented in this news item is intended solely for informational purposes and should not be interpreted as professional advice, legal opinion, or endorsement by WAY2WORLD.

We cannot guarantee the accuracy, completeness, or timeliness of the information provided as most is generated using AI. Please Note Generated with AI which can make mistakes. WAY2WORLD and its affiliates disclaim any liability for errors, omissions, or damages resulting from reliance on this content.

Readers are strongly encouraged to verify information through multiple sources and to consult with qualified professionals before making decisions based on this material.

The views expressed in this news item reflect the opinions of the author(s) and do not necessarily represent those of WAY2WORLD or its affiliates.

WAY2WORLD does not endorse or promote any specific product, service, or organization mentioned herein unless explicitly stated. We urge readers to exercise their discretion and judgment when interpreting and applying the information.

Comments made in this space do not represent the views of WAY2WORLD. Individuals posting comments assume full responsibility for their content. In accordance with Central Government IT regulations, any obscene or offensive statements against individuals, religions, communities, or nations are punishable offenses and legal action may be pursued against violators.

Source:

- https://turbostart.co/blog/indian-startup-ecosystem

- https://www.indiadigitalsummit.in/investment-trends-shaping-the-future-of-indias-startup-ecosystem/

- https://www.startupindia.gov.in/content/sih/en/international/go-to-market-guide/indian-startup-ecosystem.html

- https://papers.ssrn.com/sol3/Delivery.cfm/SSRN_ID4693720_code1676365.pdf?abstractid=4693720&mirid=1

- https://inc42.com/features/indian-unicorn-tracker-funding-investors-revenue-and-more/

- https://www.isec.ac.in/wp-content/uploads/2023/07/WP-514-Fakih-Amrin-Kamaluddin-Final.pdf

- https://wework.co.in/blogs/investment-trends-future-of-indian-startups/

- https://inc42.com/reports/indian-tech-startup-funding-report-q1-2025/

- https://www.way2world.in/weekly-updates-indias-startup-ecosystem-surges-169m-raised-2025-trends-redefine-unicorn-and-women-led-success

- https://www.way2world.in/weekly-glance-indias-120m-startup-surge-unicorn-growth-women-founders-profitable-trends-redefine-august-2025

- https://swadeshishodh.org/building-a-resilient-indian-startup-ecosystem/

- https://www.openvc.app/blog/funding-stages-pre-seed-series-a

- https://www.indeed.com/career-advice/career-development/startup-funding-stages

- https://www.financialexpress.com/business/start-ups-womens-day-india-ranks-second-globally-in-all-time-funding-for-women-led-startups-3770263/

- https://insider.finology.in/startups-india/different-startup-funding-stages

- https://startupflora.com/post/funding-process-in-india-the-complete-guide-for-startups-msmes-and-businesses

- https://yourstory.com/glossary/series-a-b-c

- https://www.qapita.com/in/blog/types-of-funding-rounds

- https://wise.com/gb/blog/startup-funding-rounds

- https://startup.theceo.in/indias-startup-ecosystem-key-players-and-trends/

- https://startinup.up.gov.in/sisfs-startup-india-seed-fund-scheme/

- https://www.indiascienceandtechnology.gov.in/funding-opportunities/startups/startup-india-seed-fund-scheme-sisfs

- https://www.india.gov.in/spotlight/startup-india-seed-fund-scheme-sisfs

- https://www.pib.gov.in/PressReleasePage.aspx?PRID=2148567

- https://www.sidbivcf.in/en/funds/ffs

- https://www.startupindia.gov.in/content/sih/en/government-schemes.html

- https://www.registrationwala.com/knowledge-base/post/business/list-of-government-schemes-for-startups-in-india

- https://www.startupindia.gov.in

- https://ipventures.in/stages-of-startup-funding-series-a-b-c-funding/

- https://www.investopedia.com/articles/personal-finance/102015/series-b-c-funding-what-it-all-means-and-how-it-works.asp

- https://rjpn.org/jetnr/papers/JETNR2508020.pdf

- https://www.business-standard.com/companies/start-ups/women-led-tech-startups-funding-drops-25-in-2024-says-tracxn-report-125030700487_1.html

- https://seafund.in/article/the-rise-of-deeptech-startups-in-india-how-deeptech-funding-is-shaping-the-future-of-innovation/

- https://blog.taxrobo.in/key-trends-in-startup-funding/

- https://www.linkedin.com/pulse/funding-trends-indian-startups-2025-where-smart-money-0zucc

Comment here